Quarterly Market Review - Q4 2022

Welcome to RPAG Quarterly Market Review for Q4 2022 where we discuss U.S. equity markets, international equities, broad U.S fixed income market, and much more.

- Kyle Olson, CFA, CAIA, Senior Plan Advisor

Summary

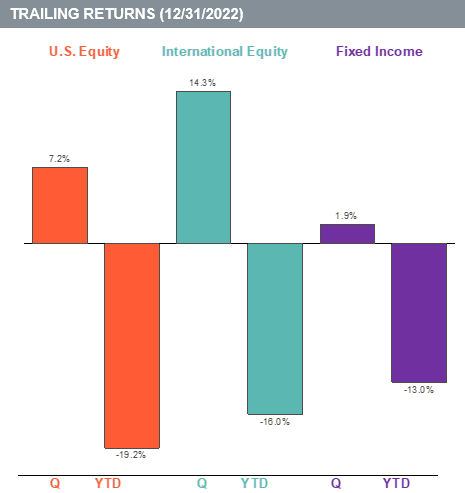

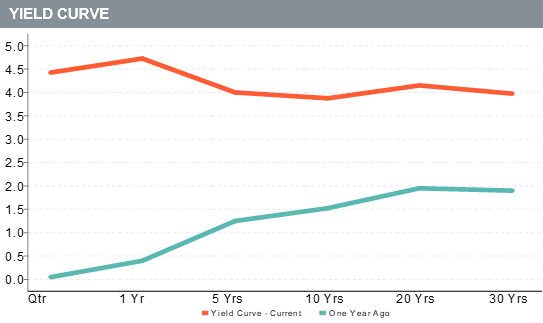

U.S. equity markets rallied in the fourth quarter, rising 7.2% (Russell 3000) on moderating inflation. The Consumer Price Index (CPI) peaked in June and has seen steady improvement since. International equities rose to a greater extent, posting a 14.3% gain over the quarter (MSCI ACWI ex U.S.). The broad U.S. fixed income market showed some improvement, up 1.9% (Bloomberg Barclays Aggregate). Despite cooling economic growth, the U.S. labor market remained tight during the quarter with unemployment at 3.5% in December. Large cap value stocks had a strong quarter, with the Russell 1000 Value up 12.4% and outperformed the Russell 1000 Growth by over 10 percentage points. The Federal Reserve raised interest rates 125 basis points during the fourth quarter. Additionally, the Fed expects further rate hikes in 2023 to combat inflation.

Quarterly and year-to-date returns of the following indices: U.S. Equity (Russell 3000 Index), Fixed Income (Bloomberg Barclays U.S. Aggregate Bond Index) and International Equity (MSCI ACWI ex U.S. Index)

Quarterly and year-to-date returns of the following indices: U.S. Equity (Russell 3000 Index), Fixed Income (Bloomberg Barclays U.S. Aggregate Bond Index) and International Equity (MSCI ACWI ex U.S. Index)

U.S. Equity

- The broad U.S. equity market, as measured by the Russell 3000 Index, was up 7.2% for the quarter.

- The best performing U.S. equity index for the quarter was Russell 1000 Value, returning a positive 12.4%.

- The worst performing U.S. equity index for the quarter was Russell 1000 Growth, returning a positive 2.2%.

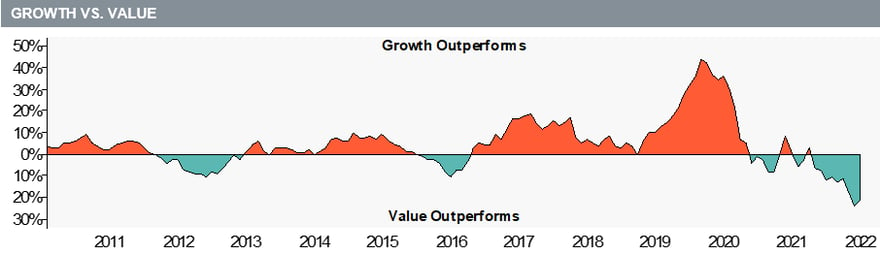

Over the last year, value stocks outperformed growth stocks by 21.60%. For the trailing quarter, value stocks outperformed growth stocks by 10.20%.

The graph above is plotted using a rolling one-year time period. Growth stock performance is represented by the Russell 1000 Growth Index. Value stock performance is represented by the Russell 1000 Value Index.

The graph above is plotted using a rolling one-year time period. Growth stock performance is represented by the Russell 1000 Growth Index. Value stock performance is represented by the Russell 1000 Value Index.

International Equity

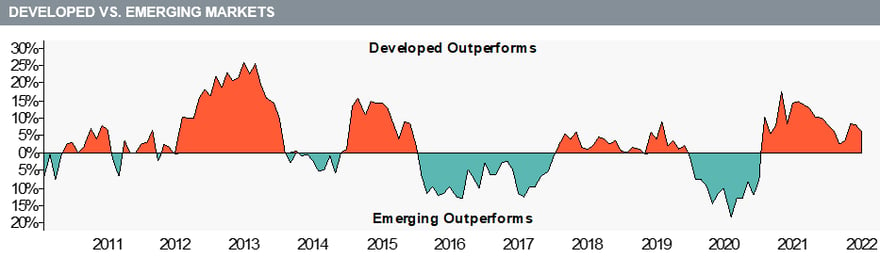

- Developed international equity returned a positive 17.4% in the last quarter (MSCI EAFE).

- Emerging market equity posted a positive 9.7% return (MSCI Emerging Markets Index).

Over the last year, developed international stocks outperformed emerging market stocks by 6.10%. For the trailing quarter, developed international stocks outperformed emerging market stocks by 7.70%.

The graph above is plotted using a rolling one-year time period. Developed international stock performance is represented by the MSCI EAFE Index. Emerging market stock performance is represented by the MSCI Emerging Markets Index.

The graph above is plotted using a rolling one-year time period. Developed international stock performance is represented by the MSCI EAFE Index. Emerging market stock performance is represented by the MSCI Emerging Markets Index.

Fixed Income

- The broad U.S. fixed income market returned a positive 1.9% (Bloomberg Barclays U.S. Aggregate) for the quarter.

- The best performing sector for the quarter was High Yield Corporate Bond, returning a positive 4.2%.

- The worst performing sector for the quarter was Government, returning a positive 0.7%.

Download a copy of this market review document by clicking here, or contact us at the email address below.

________________________________________

Looking for more information?

Contact the RPAG Support Team, support@rpag.com, to learn more about RPAG and get help with our Platform, or anything else!