What Do RKers Make of a New RPAG Offering?

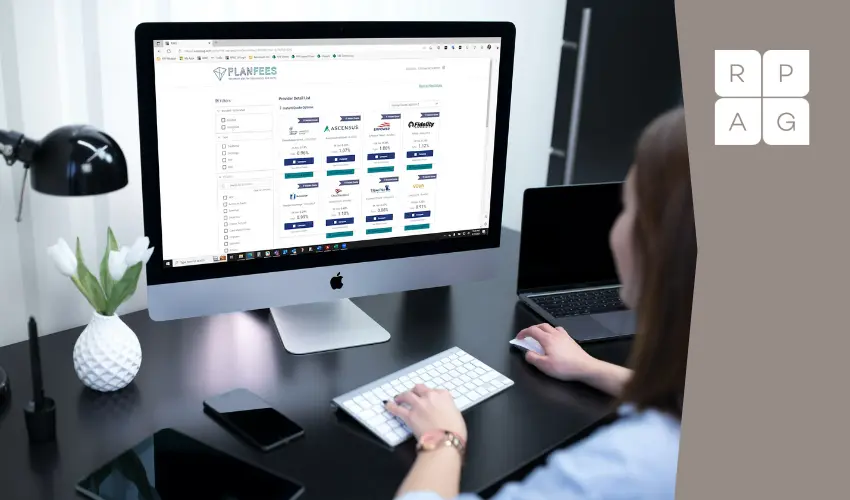

A new small plan benchmarking system from a California KPA network is live as of this week, and a number of recordkeepers involved in the product are spreading the word about its merits.

401kWire spoke with a number of firms pairing with RPAG on their new RFP Express tool. Below, insiders give insight into how the collaboration came together and which aspects of the product they're most excited about.

A Principal spokesperson writes to 401kWire, "I can confirm Principal is a participating recordkeeper in RFP Express."

Ekat Sheliga, director of institutional sales at the Standard, tells 401kWire, "We want to make it as easy as possible for an advisor to see our pricing and our services. RPAG is a huge value-add to advisors and to their members, and RFP Express is another tool in their toolbox."

Sheliga notes that the team at the Standard was approached last year about connecting to the new solution. "We communicate with them a lot, we work with them a lot, and some of our best advisors are RPAG members and leverage all of their bells and whistles."

RFP Express "ties really nicely" into an offering from Sheliga's firm called Accelerate, she explains. Accelerate's quick-quote capabilities are incorporated into the RFP Express platform.

As for what makes the RFP Express tool particularly efficient, Sheliga says, "The secret sauce ... is that actuarial metrics are automatically inputted in there, meaning that an advisor puts in fifty people, $500,000 in assets, the plan just started last year, the anticipated dollar flow, and it spits out the quote."

This stands in stark contrast to an advisor's usual process of inputting data, getting in touch with a wholesaler, explaining the unique characteristics of each plan, and then waiting for a custom quote over the course of multiple business days. "It's a very painful process and everybody's proposals are different!"

Allison Dirksen, senior vice president and head of wealth solutions sales at Voya, writes to 401kWire, "The opportunity to develop the RFP Express tool with RPAG was an extension of our already strong relationship. We were thrilled to work together with RPAG for the development of the tool to help inform the user experience and ensure it was a mutually beneficial solution for RPAG's membership base and Voya's internal and external wholesalers."

"As a result, leveraging the RFP Express tool provides the opportunity to exponentially enhance the number of quotes Voya can produce and participate in, ultimately helping to drive our ongoing sales success and provide greater outcomes for our customers," writes Dirksen.

Christian Romano, vice president of strategic partnerships at Vestwell, writes to 401kWire, "Vestwell is a proud RPAG partner. We are both committed to providing retirement plan advisors with the tools and support to better serve clients and grow their retirement plan practices."

"RPAG's RFP Express tool was created to make it easier for RPAG advisors to gather quotes and do vendor diligence for their smaller plans," Romano continues. "RPAG did the work to identify what providers work well with small plans and included Vestwell. As a leader in the advisor-sold small plan space, we are already doing business with a number of RPAG members, both in the single employer plan space and multiple/pooled/aggregated employer plan space, and are excited to work with more RPAG advisors through this new tool."

Kevin Devine, vice president and national sales director for Nationwide's retirement solutions wing, writes to 401kWire, "Nationwide is incredibly excited about this opportunity that RPAG is making available to the advisor community. While it's still in [the] very early stages of launching, we believe that this will create a powerful opportunity for more consistent benchmarking of plans, which is a best practice for all plans to do on a regular basis."

"By making this process much more efficient for advisors, RPAG has created an on-demand experience for advisors to quickly understand the overall landscape and potentially work with new or more competitive recordkeepers for that specific client."

Devine notes, "Nationwide has been involved in the early launch over the past few weeks and hearing great feedback from advisors about the speed to complete and receive analysis to keep the sales process moving forward."

Charmaine Hughes Lee, national director in business development and national accounts at Transamerica, writes to 401kWire, "Transamerica helps financial advisors grow their retirement plan business while offering outstanding client care. RPAG Advisor members can use RFP Express to run Transamerica proposals quickly and easily while continuing to receive a consultative product and plan design support experience through our distribution team."

"In addition," Hughes Lee adds, "we continue to invest in technology to better serve advisors, plan sponsors, and participants."

Nick Pagano, vice president and head of core market sales at T. Rowe Price, writes to 401kWire, "T. Rowe Price is excited to partner with RPAG and be an early adopter of RFP Express to reach thousands of advisors and help give them time back in their day through instant quotes."

"TRP has historically offered fixed pricing up to $5M; however, we recently extended our fixed pricing structure to $10M as a result of advisor feedback and to be [supportive of] RFP Express and its robust capabilities," Pagano adds. "We look forward to expanding and deepening our advisor reach through the use of the tool."

Source:- 401kwire - Andrew Lusk