Oversimplification in Target Date Funds Part I

How are custom solutions evolving to mitigate risk?

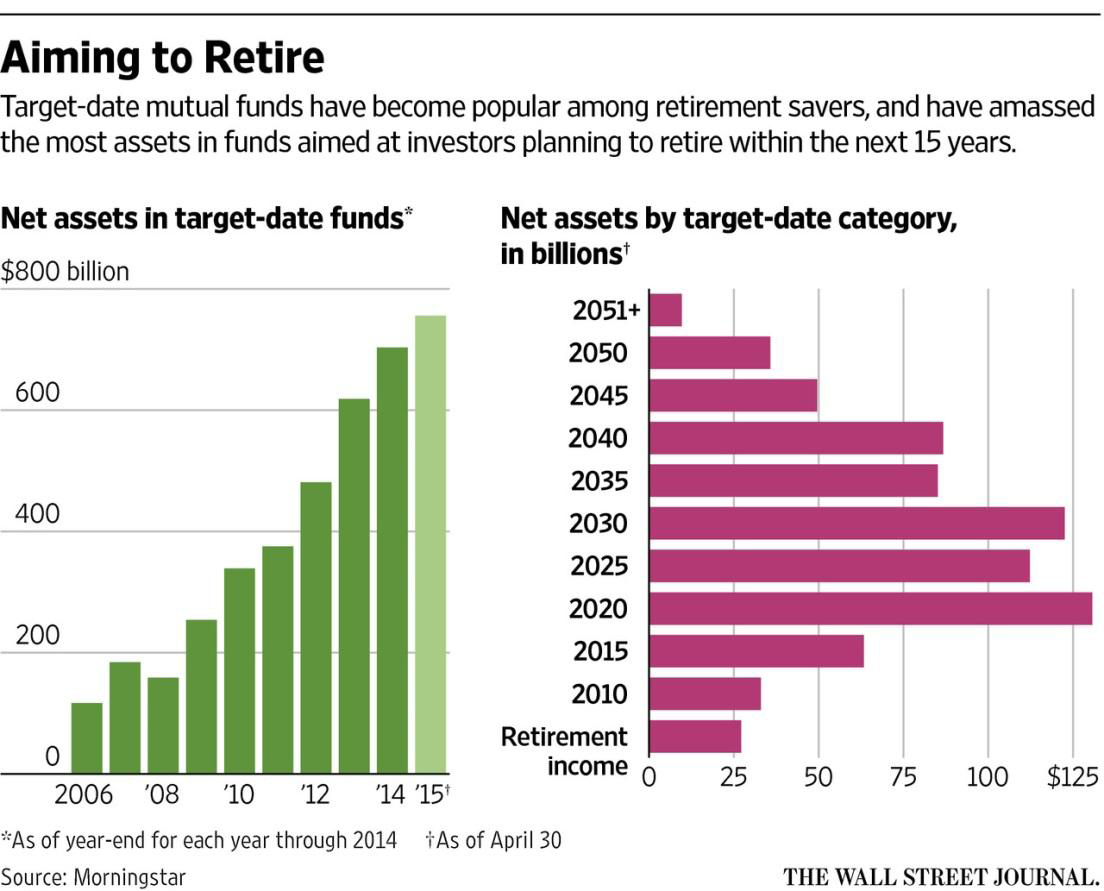

Since the Pension Protection Act of 2006, target date funds (TDFs) have increasingly found their way into retirement plans as the preferred qualified default investment alternative (QDIA) for participants who make no election. Not only have plan sponsors widely adopted TDFs as the plan’s QDIA, but participants have also gravitated to this type of fund option because of its ease of use as a “one-stop shop,” allowing the selection of one fund option based on expected retirement date. A TDF diversifies and grows more conservative over time as the participant approaches the named retirement date in the fund. The target date is the approximate date when investors plan to start withdrawing their money. The principal value of the fund(s) is not guaranteed at any time, including at the target date. At present, TDFs can be found in the majority of retirement plans and are expected to increasingly become the primary if not only vehicle for most retirement plan participants.

The simplicity of TDFs for plan sponsors and participants has been of paramount importance and a key driver for success on all levels, including adoption, utilization and regulatory compliance. But are TDFs really a “silver bullet” for plan sponsors and participants? Has the attempt to lessen certain risks in saving for retirement instead introduced new risks?

Version 1.0: Inception of TDFs

BlackRock created the first TDF in 1993. Every aspect of a TDF, from the glidepath (asset allocation) to the underlying investments, was managed by BlackRock. This single-manager, single-glidepath model is version 1.0 of the TDF. This model has seen the most growth over the past 20 plus years, as managers like BlackRock and others have built proprietary TDFs to support this fast-growing industry. Version 1.0 continues to remain the most common TDF in defined contribution plans today. One reason is the simplicity of version 1.0 TDFs. The entire investment solution is in one place, efficiently packaged. Another reason is because early on in the development of TDFs, recordkeepers typically only offered one proprietary TDF, usually their own, on their recordkeeping systems. This limited plan sponsors and participants to one glidepath and one investment manager. As the TDF industry has matured, fiduciaries and the DOL have increasingly become more concerned about the version 1.0 design because of its inherent and sometimes unseen, or misunderstood, risk to the plan sponsor and participants.

As version 1.0 providers have multiplied, the number of glidepaths has increased as well. Interestingly, there is a stark difference among glidepath providers when it comes to asset allocation; for example, an allocation to equity at retirement varies as much as 50 percent. Because there is a lack of uniformity among TDF providers, participants in one TDF series are likely on a very different glidepath to retirement, or have a very different asset allocation, than participants in another TDF series.

For example, T. Rowe Price, a large equity manager, has one of the more aggressive glidepaths of version 1.0 TDF providers, with approximately 55 percent equity exposure at retirement. PIMCO, on the other hand, a large bond manager, has approximately 20 percent equity exposure at retirement (with a large percentage in bonds). Certainly, investment management skill and expertise in their business segments likely drive the allocation.

These large differences in equity exposure create significant variance in participants’ retirement outcomes because equity risk is the primary driver of glidepath risk. To date, the message around TDFs has been that they grow more conservative over time. In this simplicity, the degree and magnitude of this shift to more conservative assets has been overlooked. Participants on different glidepaths face different risks; the biggest risk is driven by asset allocation to risk-based assets like stocks versus more conservative assets like bonds and cash.

TDF providers under version 1.0 not only determine the single glidepath or asset allocation, they also select and populate the TDF series with their own investment product. While the glidepath may be the biggest driver of retirement outcomes, it is the investment product within the TDF that typically dictates the fees paid to the provider.

As more and more attention has turned to the underlying investment strategies within a TDF, more evidence suggests that plan sponsors make accommodations for underperforming investment strategies. Clearly, better fiduciary governance can be applied at the TDF level. Unfortunately, even if applied, version 1.0 allows no flexibility to fiduciaries to ensure that there are glidepath options for the individual or that underperforming managers can be replaced. More flexibility is needed if plan sponsors are to treat TDFs the same as they do other investments offered within the plan.

This is an excerpt of flexPATH Strategies’ white paper, Oversimplification in Target Date Funds Endangers Participants’ Retirement Savings - How are custom solutions evolving to mitigate risk? Next month we will release Part II of the white paper and introduce version 2.0 which sets the stage for version 3.0. View the white paper in its entirety here.

ACR#180988 04/16