How to Encourage Positive Retirement Outcomes in Tax Exempt Plans

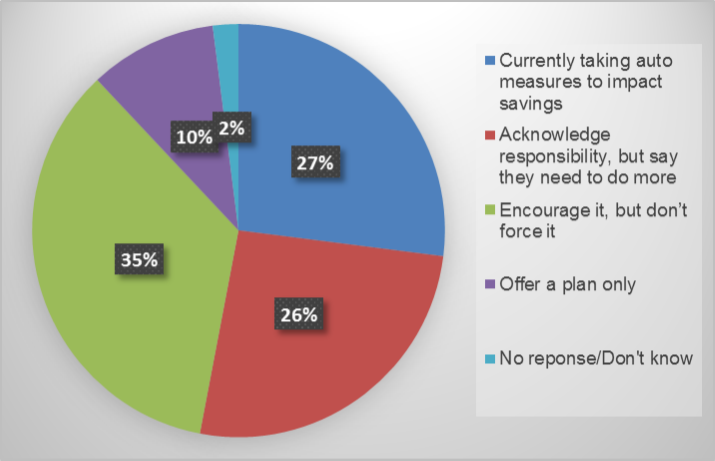

One of the major trends right now in retirement plans is the use of automatic plan design features to encourage plan participation and retirement participation. We have seen a steady increase in adoption of automatic plan design features, at large, in the past few years; however, tax exempt organizations seem to have a different attitude towards the implementation of these strategies. Compared to the general retirement plan population, tax exempt organizations seem to be a bit more split when it comes to measures that would force their employees into retirement contributions. A look at the chart below tells us that, in summation, only 27 percent of tax exempt plan sponsors currently include some type of automatic plan design feature.¹ Plan sponsors of tax exempt organizations generally view retirement plans as another component of their employee benefits offering; putting the decision-making control in the hands of their employees. In addition, tax exempt organizations tend to be more wary of fiduciary liability; so they prefer to be more hands off.

Tax exempt plan sponsors attitude towards automatic features to encourage retirement plan contributions¹

Retirement Outcome Checklist

Entice participants to stay - Research shows us that the implementation of a company match can actually triple the odds of plan participation.² Because of budget constraints and the rise in healthcare costs, plan sponsors may be hesitant to implement a matching contribution to encourage plan participation.

Make investment selection easy - Make investment decisions easy on participants. Investment decisions can be overwhelming as most participants have little to no investment experience. Be careful not to over inundate them with a large menu of investment options. Instead, offer a limited menu of individual investment options that cover the main asset classes. In addition, offer an off-the-shelf target-date fund to provide participants with a pre-allocated mix of investments based on their anticipated retirement year. Lastly, take it a step further and offer a managed account option in the plan. This provides the greatest degree of direction for participants and allows an experienced third party investment manager to create and manage a pool of investments that most closely aligns with the participant’s risk tolerance, expected year of retirement and personal preferences.

Implement financial wellness programming - Twenty-three percent of retirement plans say they offer a financial wellness program.¹ Employees in some tax exempt markets are paid less than their for-profit peers, making them susceptible to financial struggles – including student loans and various debt. Offering a financial wellness program can help provide a structured plan to help participants rid themselves of debt. This could lead to higher plan participation and contributions. After all, people who are not in a good financial situation view retirement planning close to last on their list of financial obligations.

Document the plan strategy - Implement an investment policy statement and investment committee charter. This helps to put all of these plan tactics in action and holds the organization and plan fiduciaries responsible for making sure the plan is in good order.

While most of these tactics are beneficial to all organizations, tax exempt organizations are unique in that they are still lagging behind traditional 401(k) plans in the implementation of strategies to encourage retirement preparation.

For more information on tax exempt plan strategies, please contact your plan consultant.

- Not-for-Profits Recognize Responsibility in Encouraging Positive Savings Behaviors, PSCA, 12/17/14

- The Plan Participation Puzzle: Comparison of Not-for-Profit Employees and For-Profit Employees, LIMRA, December 2010.4

This is a condensed article written by OneAmerica.

ACR#186586 05/16