Staying the Course - Coronavirus and Past Market Epidemics

As of February 28, 2020, global stock markets have entered “correction” territory, defined as a 10% decline from the index high. This is in large part due to the uncertainty surrounding the new coronavirus, first detected in Wuhan City, China, but now detected in 37 locations internationally, including the United States. There certainly will be an economic impact, as growth slows due to quarantines, less consumer traffic and lower factory output, but it is still to be determined its final result on global growth. Stock markets, however, do not like uncertainty. As uncertainty has grown around this new coronavirus, the resulting fear has led to a quick and notable downward movement in the market.

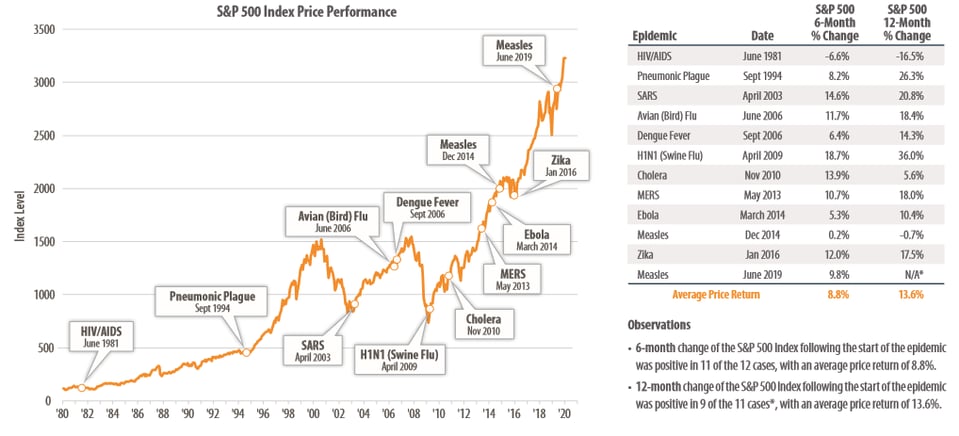

Epidemics in the past have also led to sharp pull-backs in the markets. Over the long-term, however, the stock market has weathered past epidemics. The below chart looks at the historical returns of the S&P 500 Index during multiple epidemics over the last 40 years. Over the 6 and 12 month periods following an epidemic, the S&P 500 performance has, on average, been positive.

During times of uncertainty and market volatility, while it is prudent for plan participants to “stay the course”, it is also prudent for them to review their investment strategies (e.g., “What is my risk tolerance? When will I retire? When will I need this money?”) to ensure they are on the most appropriate path. A new course of action is only warranted if it is more appropriate than the current path. Evaluating one’s own situation—having the most appropriate asset allocation or glide path and high enough contribution rates—can lead to the most positive actions a participant may take in saving for retirement. Bailing out of the markets and a retirement plan is typically an imprudent action, often detrimental to reaching future long-term retirement goals. Data indicates that individuals attempting to time the market generally proves futile. Current market conditions rarely provide a clear direction as to the future performance of the markets.

The U.S. market in particular has been dynamic and resilient in moving on from crisis after crisis throughout history. The recent market volatility should remind plan participants to focus on what they should be doing on a regular basis: Be mindful of the situation, but diligent about your investment strategy. Participants need to act in their own best interests while the stock market reacts to the current coronavirus and the uncertainty it brings: another bout of expected short-term market volatility.

For more information on staying the course, contact your plan advisor.

Chart Source: First Trust (Bloomberg, as of 2/24/20. Month end numbers were used for the 6- and 12-month % change. *12-month data is not available for the June 2019 measles. Past performance is no guarantee of future results. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Returns are based on price only and do not include dividends. This chart is for illustrative purposes only and not indicative of any actual investment. These returns were the result of certain market factors and events which may not be repeated in the future. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial advisors are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.)