On August 3, 2022, the IRS announced in Notice 2022-33 that it is extending the deadline for amending a retirement plan to reflect the revisions to Section 2203 of the Coronavirus Aid, Relief, and Economic Security (CARES) Act made by the Setting Every Community Up for Retirement Act of 2019. Section 2203 concerns a waiver of required minimum distributions (RMDs).

The RMD temporary waivers for 2020 now have an extended amendment deadline for section 2203 of the CARES Act. Notice 2022-33 does not extend the deadline for section 2202. The deadline to amend a qualified or section 403(b) plan for these provisions remains the end of the 2022 plan year.

Notice 2022-33 also extends the deadlines for amending a retirement plan or IRA to reflect certain provisions of:

• The Setting Every Community Up for Retirement Enhancement (SECURE) Act; and

• The Bipartisan American Miners Act of 2019.

It does so by modifying Notice 2020-68, 2020-38 IRB 567, and Notice 2020-86, 2020-53 IRB 1786.

Notice 2020-68 reiterates the deadlines to amend a retirement plan for provisions of the SECURE Act or Miners Act. For example, the IRS advises that the deadline to amend a qualified plan that is not a governmental plan or collectively bargained plan is the last day of the first plan year beginning on or after Jan. 1, 2022.

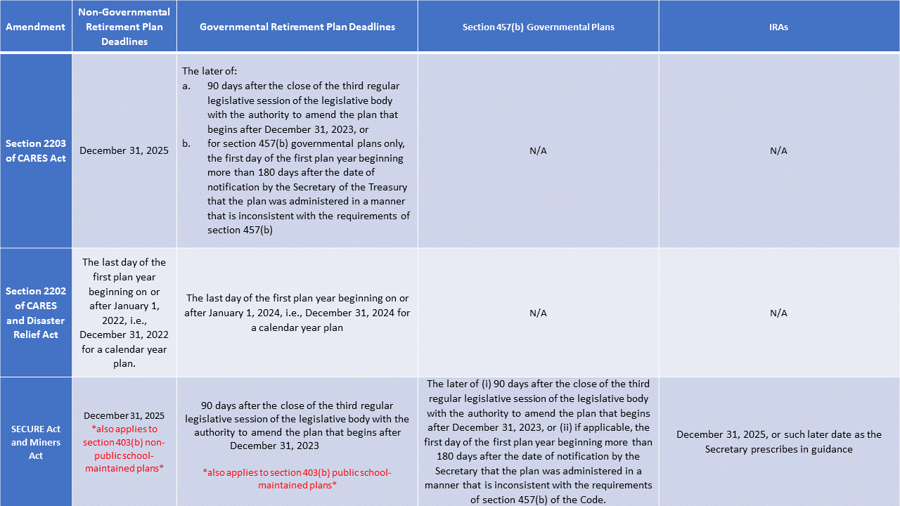

For a downloadable PDF of the deadlines regarding non-governmental, governmental, section 403(b), section 457(b), and IRA plans, click here.

Disclaimer: This article is for financial professional use only. Not for plan sponsor or participant use.

Disclaimer: This article is for financial professional use only. Not for plan sponsor or participant use.

_______________________________________

Looking for more information?

Contact the RPAG Support Team, support@rpag.com, to learn more about RPAG and get help with our Platform, or anything else!

Not an RPAG Member?