2024 Regional Summits | Target Date Fit Analysis

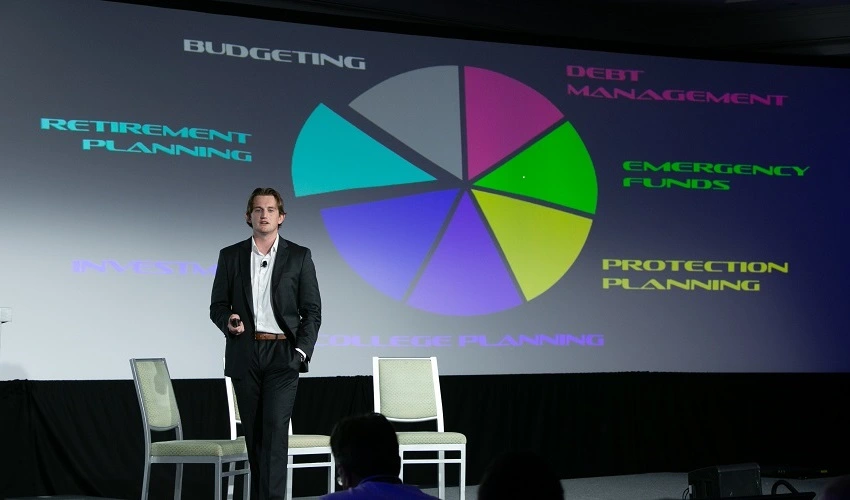

Knnin (KC) Chiravanich, an Investment Analyst at RPAG, discussed how the Targeted Fit Analysis and the TDF Analyzer Tool are crucial tools that can greatly improve retirement plan management techniques. Based on various risk considerations, these solutions are specially made to ensure that target date funds (TDFs) are appropriate for particular retirement plans.

The TDF Analyzer offers a simplified procedure for generating detailed data to determine whether the plan's target date fund is compatible with the risk tolerance of the customer. This can be very useful for both prospective clients and existing clients who want to make sure their selected TDF is still relevant in the future. When approaching a potential client, demonstrating that you can analyze their TDFs for suitability can be a game-changer.

KC emphasized that many clients might select a TDF based on cost or past performance, but this isn't always the most prudent approach. TDFs have become one of the most widely used investment options in recent years due to their significant growth in use, but not every TDF is made equally. Many plan sponsors and participants may be unaware of the important distinctions between them. Proper due diligence helps protect plan participants while also mitigating fiduciary risks for plan sponsors. Inadequate fund selection could leave participants exposed to more risk than necessary, particularly during market downturns.

KC highlighted some compelling statistics to illustrate the growing use of TDFs. Currently, 83% of plan participants in all retirement plans utilize TDFs in some way. More strikingly, 59% of participants have their entire balance invested in a single TDF. Over the past decade, contributions and assets in TDFs have nearly doubled. Given the popularity of TDFs, KC posed a critical question: "Is this the right targeted fund for my client or prospective plan?"

There are over 100 different TDFs available in the market, each with varying levels of equity exposure at different stages of the glide path. He explained that these differences could have a significant impact on the accumulation phase of retirement savings, and more importantly, on the level of risk participants face as they near retirement. For example, during market downturns such as the global financial crisis or the COVID-19 pandemic, the best-performing TDFs were down by only 8-10%, while the worst-performing TDFs were down by 51% or more.

KC used the following example to demonstrate this: Consider two neighbors who are perhaps 63 or 64 years old and are only a year or two away from retirement. While the other person's assets are put in an aggressive TDF that loses 50% in a market collapse, the first person's whole 401(k) is placed in a conservative TDF that only loses 10%. The difference could mean one retires on schedule, while the other faces severe financial insecurity.

He also emphasized the Department of Labor's suggestions for choosing TDFs, which include matching participant characteristics to the TDF, comprehending the underlying investments, examining costs and fees, taking into account non-proprietary or bespoke possibilities, and recording the procedure. By giving each TDF a risk level—conservative, moderate, or aggressive—RPAG's TDF Analyzer Tool incorporates these suggestions and guarantees a closer fit with participant demands.

There is a significance of doing routine assessments and making sure the chosen TDFs continue to be appropriate for the plan participants by utilizing tools such as the TDF Analyzer. It's advised to conduct a plan fit analysis to take participant demographic changes, plan mergers, and acquisitions into consideration every three to five years. With the widespread adoption of TDFs, conducting proper due diligence is more important than ever to protect both plan participants and fiduciaries.

View the presentation slides here!

________________________________________

Looking for more information?

Contact the RPAG Support Team at support@rpag.com to learn more about RPAG and get help with our platform, suite of services, next-gen technology, or anything else!